National Down Syndrome Conference Resources

Adults with Down Syndrome

Alternative Communication/AAC

Children with Down Syndrome

Congressional Agenda

Dating and Relationships

Down Syndrome & Autism

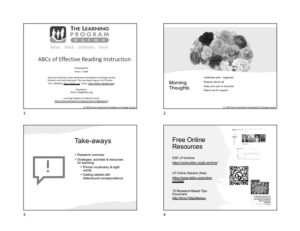

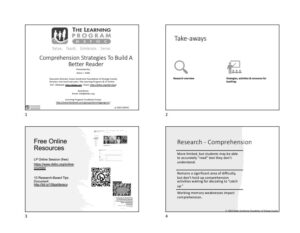

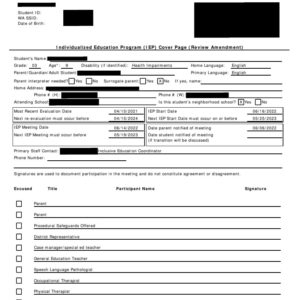

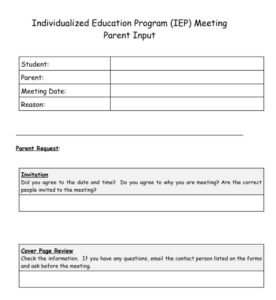

Education and IEPs

Healthy Boundaries

Life After High School

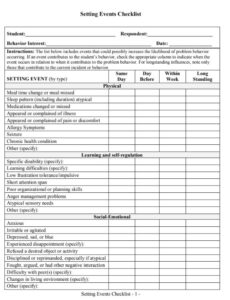

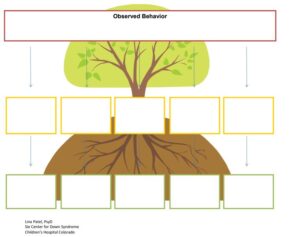

Mental Health and Behavior

New and Expecting Parents

Nutrition and Exercise

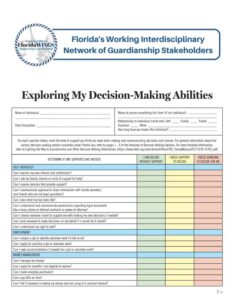

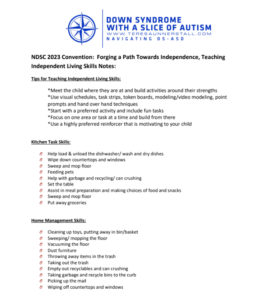

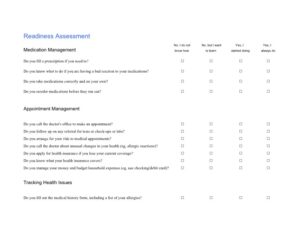

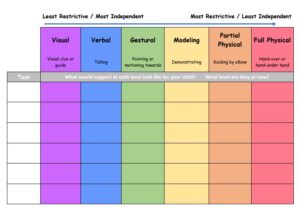

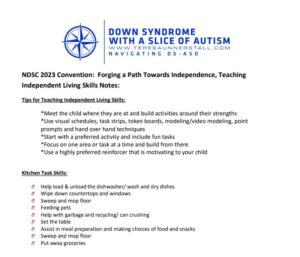

Path Towards Independence

Potty Training Success

Recursos en Espanol

Self Determination

Sibling and Family Caregivers

Social Security Disability

Students with Down Syndrome

Special Needs Life Planning

Therapy for all Ages

Sharing Down Syndrome Arizona is a 501(c)3 nonprofit organization and all contributions are tax-deductible to the full extent of the law. EIN: 86-0822557.

Our Arizona State Tax Qualifying Charitable Organization and our QCO Code is 20543.

Sharing Down Syndrome Arizona is a part of the Fry’s Community Rewards Program.

Receive a dollar-for-dollar tax credit when you direct a portion of your state tax dollars to support Sharing Down Syndrome Arizona. This incentive is at no cost to you. 1. Donate up to $800 (up to $400 if filing single) to Sharing Down Syndrome AZ and receive a credit on your taxes for the full amount of your donation.

2. Provide your donation receipt and our QCO code 20543 to your tax preparer.

**For more information on the AZ Charitable Giving Tax Credit visit AZDOR.gov.

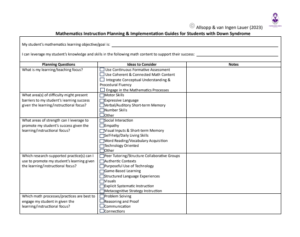

Math Planning and Implementation Guides

Math Planning and Implementation Guides